In the field of finance and, in particular, fund management, risk is an inevitable aspect of investment. Fund management is thus a delicate balance between risk and reward that requires a proactive approach. While risk is often viewed as a negative aspect that needs to be eliminated, the reality is that risk is necessary to make gains. The Global Association of Risk Professionals (GARP) is the standard bearer of the financial risk management field, and these professionals have defined risk as “the Likelihood of an adverse event, or a likely threat and its potential impact on an institution”. Risk-optimised asset allocation has its history in the 1950s with the advent of Modern Portfolio Theory, a notable work by Harry Markowitz that led to more variations of the methods by Fischer Black, Myron Scholes and Robert Merton that piqued interest in risk Management and Management techniques, from the early 1970s onwards. The common theme of these portfolio risk models was optimising return and minimising risk.

The Importance of Risk Budgeting in Investment Fund Management

While the misconception is that an effective and proactive risk management framework in Fund management aims to eliminate risk, the reality is far from that. A proactive Risk Management Framework is a strategic attempt to maximise investors’ returns while navigating the narrow straight of the inevitable losses. It is a delicate balance of mitigation balancing and inevitably accepting some risk. This may be viewed as Risk Budgeting.

What is Risk Budgeting and Why is it Crucial for Fund Managers?

Risk budgeting is a concept similar to any other form of budgeting; it identifies, quantifies, mitigates, and monitors risk factors. In fund management, risk budgeting views risk as a resource to be allocated in each asset class, strategy and across the fund. In order to achieve this, the funds’ risk manager aims to measure metrics that are relevant to each strategy; for example, some funds utilise a Risk-Based Tactical Asset allocation approach to maximise returns in high-volatility portfolios and when they anticipate higher risk or reward environments. The ultimate aim is to maintain stable returns no matter the prevailing market sentiment. Analysing and understanding the likelihood of the impact of Market, Operational, Reputational, and Regulatory risks allow portfolio managers to construct and manage optimised Portfolios. The primary metric that fund managers tend to focus on is Market risk, which we will look at first as these are the risks that the Managers cannot control.

Managing Market Risk: Strategies for Fund Managers

Market risk is generally defined as the risk emanating from the market factors the organisation is exposed to, such as interest rates, exchange rates, commodities prices, and movements of asset prices. Market risk can be considered the risk that impacts assets regardless of how theories are selected. Thus, asset and fund managers heavily monitor this and try to predict how future market factors will impact current portfolio assets. While many varying methodologies tend to be utilised (from quantitative, speculative, or sheer voodoo betting models), the consensus is that these factors will make or break portfolios.

A very warm reminder of the impact of market factors seen in July 2024 was the selloff prompted by the interest rate hike by the BOJ. As the BOJ had historically maintained a low interest rate environment compared to its G7 peers and a traditionally stable market, this prompted fund managers to borrow FX at a lower rate, i.e. the Yen and invest in higher rate markets like the US. When the BOJ announced its monetary policy measures to increase the rate of the YEN, this caught many fund managers off guard, leading to the mini-crash at the beginning of the month. The sell-off that ensued as managers tried to cover their rates led to the market wipeout of 6.4 trillion dollars in less than a week.

Effect of the Great Carry Trade on the S&P 500

Proactive risk managers had already started disinvesting out of the Great Carry Trade as the markets became more volatile, with central banks around the world shifting rate policies. Market factors have the most direct impact on a portfolio, and this is why fund managers actively track them against the portfolio by looking at factors like Market Sentiment, Value at Risk Models and portfolio correlations to the highest impact factors. Proactive risk management in a Fund Manager’s toolkit weighs the short-term gains of these impacts against the likely long-term losses that might not be avoidable. Fund managers also look at the risk factors that are more directly in their control, namely Specific risks.

Diversifying Specific Risk: A Key Strategy for Fund Managers

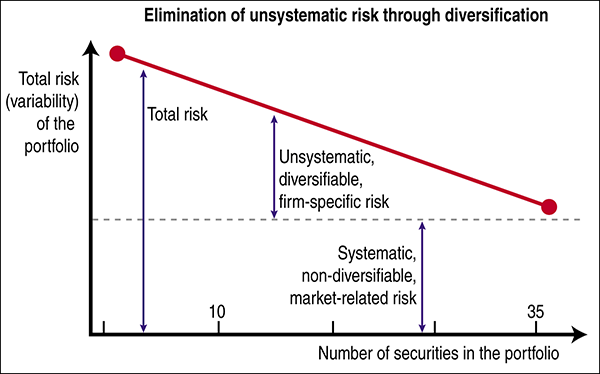

Fund Managers must proactively manage the risk that arises due to the assets held in the portfolio. This risk that is Specific to the assets has been called Diversifyable or Idiosyncratic Risk. It is inherent in any security in an asset class and the macroeconomic considerations.

Mitigation of Specific Risk through diversification

These unsystematic risks may be specific to a business, such as competitive risks, financing risks, managerial or operational risks, or sector-specific risks like the dependency or correlation of assets with company-specific risks. They can be varied by diversification and optimised to maximise returns.

The Specific sector risk can be viewed through the lens of Bitcoin against Equities in 2021- 2022, in particular. The massive swings of drawdowns and recoveries in this period for crypto assets were in stark contrast to the general stability of the Market.

Difference of Bitcoin and Equities in the 2021-2022

Why Proactive Risk Management is Essential for Successful Fund Management

Risk is an implicit factor that has undoubtedly been embedded into every facet of Fund administration. The proactive approach to Risk management is ultimately a balancing act that involves a level-headed equivalence between acceptance mitigation and analysis. Eliminating risk is impossible and ultimately leads to funds returning poorly. Regardless of whether the type of risk is evident, market or Specific, fund managers are constantly required to maintain an active awareness of the risk the fund might be exposed to. This proactiveness is what leads to successful and long-lasting funds.

At Lima Capital, risk management is at the core of our investment approach. We endeavour to empower fund managers, investors and counterparts in the industry to navigate the murky waters of fund risk management across all asset classes. Our experience in multiple international hubs has allowed us to glean knowledge from across the globe and maintain a proactive and innovative base for risk management across our services.