Enhance Your Overall Client Experience by Providing a Comprehensive Suite of Services

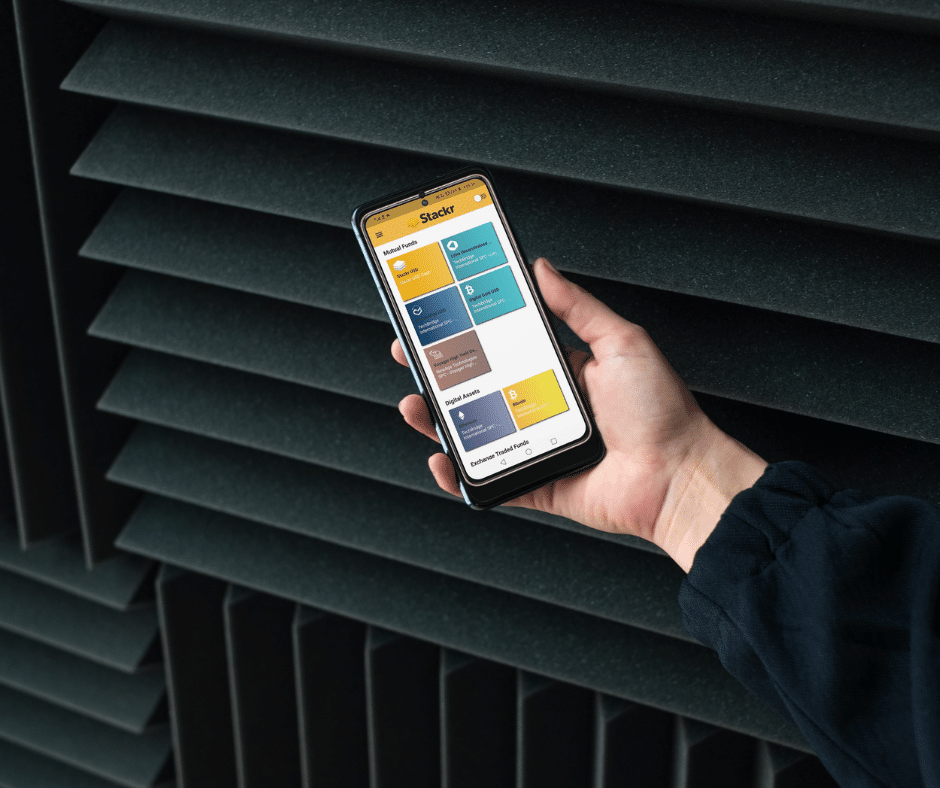

Unlock the power of Stackr, Lima's cutting-edge distribution product, to revolutionize your long-term savings journey. Experience a comprehensive suite of services that streamline wealth management for financial advisors and empower individual investors to take control of their financial future.

Integrated Wealth Management Solution

Elevate Your Client Experience with Stackr

Stackr’s innovative savings platform empowers financial advisors by streamlining their workflow and enhancing their value proposition. With customizable fee structures, advisors can align pricing with client needs, increasing the value they provide. Stackr simplifies the investment process through consolidated client reporting, seamless onboarding, and open architecture options, saving advisors time and resources. With easy portfolio monitoring, brokers offer transparent experiences, instilling trust, and peace of mind. Stackr ensures investor protection, building confidence in advisors’ practices while operating in a regulated environment. Elevate your practice with Stackr, offering clients a simple, secure, and cost-effective savings solution.

WHY CHOOSE STACKR

Why do Financial Advisors Choose Stackr?

Effortlessly onboard clients with Stackr's fully digital process

Align your pricing with the needs of your clients and increase the value you provide.

Ýou can monitor your clients' portfolios with ease and provide a seamless and transparent experience.

The Long-Term Savings Solution

Craft Personalised Portfolios with Stackr's Open Architecture

Stackr is the next generation savings solution that offers an innovative approach to managing long-term investments. With Stackr, you can confidently invest in your future while enjoying a seamless and user-friendly experience. Explore the features we offer to empower your client experience:

- Effortless Client Onboarding: Experience a fully digital onboarding process that eliminates paperwork and ensures a smooth integration into the Stackr platform.

- Consolidated Client Reporting: Access comprehensive and consolidated reports, providing a holistic view of your clients’ investments and performance.

- Customizable Fee Structure: Align your pricing with client needs by leveraging Stackr’s customizable fee structure, enhancing the value you offer as a financial advisor.

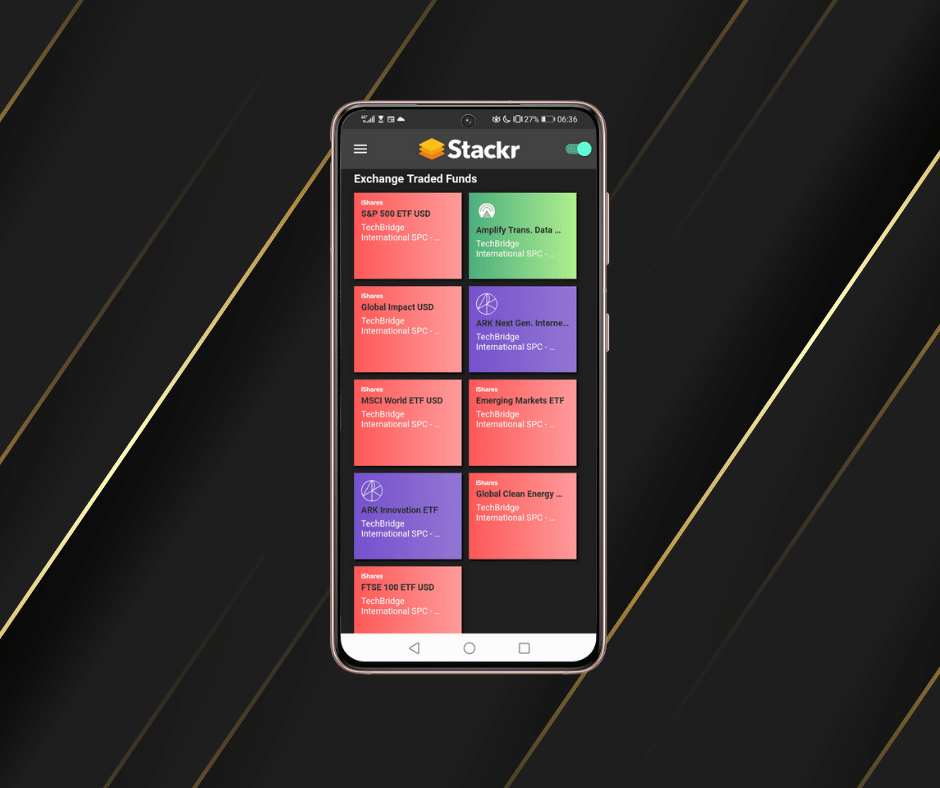

- Open Architecture Options: Benefit from a wide range of investment options through Stackr’s open architecture, allowing you to tailor portfolios based on your clients’ preferences and goals.

- Seamless Portfolio Monitoring: Keep a close eye on your clients’ portfolios with ease, ensuring transparency and proactive management.

- Regulated Environment: Operate within a regulated environment, providing investor protection and instilling trust and confidence in the Stackr platform.