On 7 May 2025, the Mauritian Government released its second National Risk Assessment (NRA). This in itself was an achievement for the jurisdiction in its endeavour to be recognised as a mature IFC that holds up international standards and protects investments through a stable financial system. While the national risk rating is Medium-High for money laundering and terrorist financing, iit can look daunting on the surface, the nuances of the report must also be taken into account to recognise the opportunities that it presents, particularly in the securities sector. For fund managers, the revised ratings translate into lower perceived transaction costs and smoother onboarding with correspondent banks

This guide sets out what has changed, why digital threats matter, and how a proactive compliance strategy can turn regulation into an advantage.

Why the New Ratings Matter for Fund Managers

As of the last statistics issued by the regulator, the Financial services sector already generates roughly:

- 13.4 % of GDP,

- support 17,000+ jobs

- and feed MUR 15 billion in tax revenue.

This contribution hinges on the efficacy of Mauritius’s AML/CFT legislative and enforcement framework. This is how correspondent banks thus judge it, and institutional investors price it. As a securities jurisdiction, the rating of the sector as medium to low shows that if we continue to be proactive in managing triggers as a jurisdiction, the risk signals and transaction costs will continue to be priced lower and global capital will find an efficient and stable gateway into Africa.

- This new NRA highlights how far Mauritius has come from 2018 to overhaul the national framework and increase its international competitiveness.

- This forward-looking position secures a steady and predictable regulatory framework, which is critical in long-term growth. International investors and correspondent banks rely on this transparency as a compelling confidence-building tool. It demonstrates that not only is Mauritius a jurisdiction that has understood its risk profile, but that it also needs to manage the risk proactively, which again supports the reputation and reliability of Mauritius as an international financial centre.

From Medium‑High to Medium: Progress Since 2019 in the Securities-sector

The securities sector has moved from a Medium‑High to a Medium ML risk rating and now has a clear TF rating for the sector, which has a Low TF score—an achievement few fund managers in peer IFCs can match. As shown, this indicates that the securities sector is doing better than the national average when it comes to risk exposure management. Entry of new Vehicles, such as the VCCs is therefore sustained within an environment which has well-established frameworks available

In the 2019 NRA, the securities sector was identified as having a Medium-High vulnerability to money laundering. This rating placed it among several other key sectors that contributed to the country’s overall Medium-High ML risk profile at the time. The assessment was part of a foundational effort to identify and understand the risks across the entire economy, which spurred significant legislative and regulatory reforms.

The 2025 NRA shows a marked improvement, with the securities sector’s ML risk being downgraded to Medium. While the assessment acknowledges that risks persist due to the international nature of transactions and the use of complex legal structures, it crucially concludes that these are effectively managed. The report explicitly states that “comprehensive AML controls helped to mitigate” these risks. Furthermore, the 2025 NRA provides a new, specific, and very positive rating for the sector’s exposure to terrorist financing, assessing it as Low. The report attributes this directly to the “stringent measures in place” which have made the sector an unattractive channel for potential terrorist financiers.

Digital Risk, Regulated Reward: The VAITOS Dimension

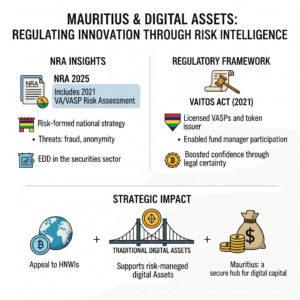

The National Risk Assessment (NRA) report 2025 reflects the growing relevance of financial technology, including the knowledge derived from the National Risk Assessment of Virtual Assets (VAs) and Virtual Asset Service Providers (VASPs) in 2021.

Mauritius has been vocal and proactive in addressing these threats, which makes the island a safe destination for innovations in digital assets. VA/VASP risk assessment in 2021 led to the adoption of the Virtual Asset and Initial Token Offering Services (VAITOS) Act to create a regulated space in which securities companies and fund managers could operate comfortably with licensed VASPs.

NRA insights into the threat of digital assets, including electronic fraud, enable the securities industry to strengthen its due diligence functions, establishing itself as a reputable provider to individuals with high net worth who are interested in engaging digital assets.

The decision frameworks built up by the VAITOS Act have introduced regulatory certainty that allows fund managers to take risks on new regulated offerings that bridge the gap between traditional finance and the digital world, appealing to global capital interested in finding secure investment opportunities in the digital asset landscape.

Level Compliance: Governance That Builds Investor Trust

Far from being solely a risk register, the NRA provides a strategic framework that private sector firms can leverage to enhance compliance effectiveness, foster innovation, and build investor confidence—particularly in the fast-growing virtual asset space regulated under the Virtual Asset and Initial Token Offering Services (VAITOS) Act. Embedding the Compliance and Risk function into the boardroom enhances the ability to make board-level risk-informed decisions about products and operations. This allows fund managers and FIs to capitalise on the myriad of opportunities that are being created by this new NRA while maintaining a high-level insight into the shifting Risk Landscape in real-time. Further streamlining this shift would be to allow Compliance voting power in certain decisions, particularly those about product and onboarding risk.

Predicate offences, which are classified as predominant threats to the Mauritius financial ecosystem, have been firmly listed by the NRA, including fraud, corruption, tax evasion, and drug trafficking. The firms in the private sector can particularly use the opportunity to match risks of customer and transactions to this taxonomy that has been nationally supported taxonomy. The ability of firms to tag client files and transactions alongside categories of NRA allows such companies to create more accurate risk portraits, generate more practical Suspicious Transaction Reports (STRs) and aid in a more responsive regulatory environment.

The VAITOS Act provides a well-controlled, structured method through which financial services institutions can participate in regulated virtual asset service providers (VASPs) and initial token offering (ITO) issuers. Such legal certainty is important in bringing in high-net-worth individuals (HNWIs) and capital flowing globally with compliant interest in investing in digital assets. Fund managers and securities firms can stay on the cutting edge of innovation and strong compliance controls, through a strategic partnership with licensed VASPs and integration of digital assets services and products.

Action Points & Lima Capital’s Fast‑Track Solution

The 2025 National Risk Assessment is a landmark publication that the Mauritian securities sector must accept as a token of its formidability and a roadmap to its future. The report clearly confirms the strong compliance culture within the industry and offers such strategic intelligence that helps it navigate the changing landscape of risks across the world with confidence.

The securities industry can readily take advantage of the NRA and strengthen investor confidence, capture reputable international alliances, and strengthen its competitive advantage. It reaffirms that the industry is not merely an actor within the Mauritian financial system, but a central form of its integrity and an establishment to its future involvement as an International Financial Centre with respect to excellence, security, and good regulation.

The partnering Lima Capital LLC, will enable you and your fund to have itself aligned with a fund structuring platform that will make your Mauritius fund compliant with the 2025 NRA and that is intended to maximise on the opportunities that the new report has to offer.

Communicate with our team to consider how you can use our successful track record to help procure licences, streamline governance and assure global investors within a single, simplified mandate.